does draftkings send tax forms

Does DraftKings mail tax forms. If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC.

Draftkings Sportsbook Promo Code 1 050 Free Bonus March 2022

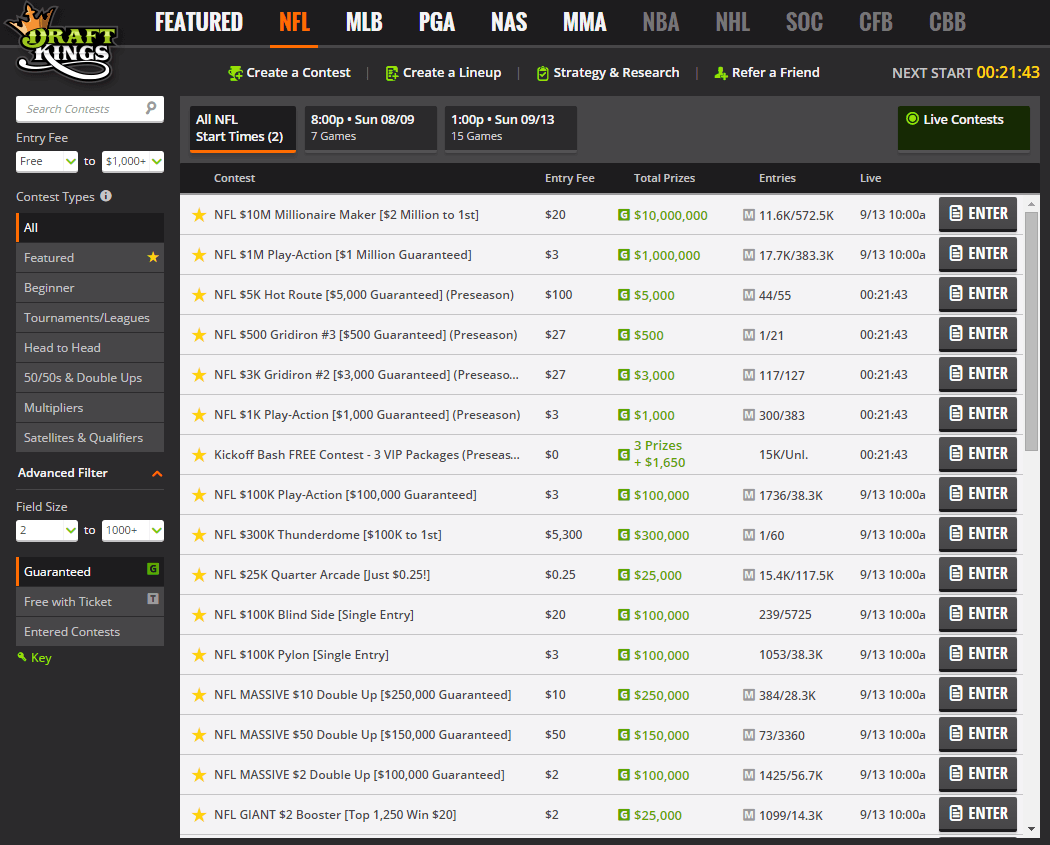

If you have winnings of over 600 from any Daily Fantasy Sports site such as FanDuel or DraftKings you will likely receive a Form 1099-MISC with the amount shown on Box 3.

. Does DraftKings issue tax documents. If you select to receive your winnings via e-wallets such as PayPal the reporting form may be a 1099 -K. A separate communication will be sent to players receiving tax forms once they are available for download in the DraftKings Document Center accessible via the DraftKings website.

If you strike lucky and you take home a net profit of 600 or more for the year playing in sportsbooks such as DraftKings the operators have a legal duty to send both yourself and the IRS a Form 1099 -MISC. You can expect to receive your tax forms no later than February 28. This is standard operating procedure for daily and traditional sports betting sites and is one of the requirements for DraftKings and sites like it to stay in business.

Draftkings seems to think that since they have the option to file for an extension they should do that most years because they cant do things in a timely fashion. How much loss can you write off. FanDuel sent me a tax form just the other day dont use draftkings so Im not sure how they go about it.

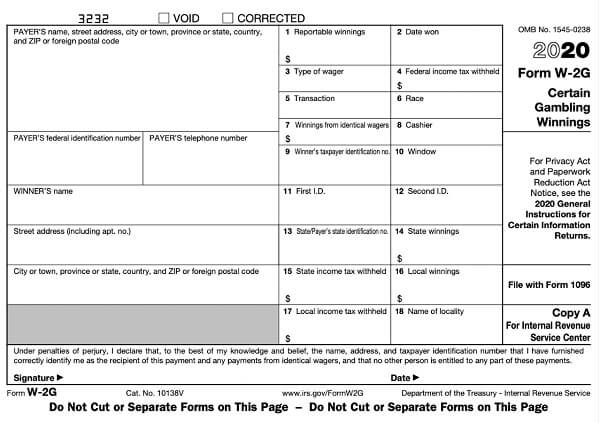

Form W-2G from DraftKings just sharing We will issue a W-2G form each time a player has a payout of 600 or more no reduction for the wagered amount and a return that is 300X the amount wagered. August 13 2021 0844. The answer is yes your cumulative net profit is taxed and DraftKings is contractually required to send a 1099 tax form to any player that nets of 600 in profit in a calendar year.

Ive never needed one from Draft Kings so not sure on that front. First of all you may not have hit the 600 threshold in profits last year to require a 1099 form to be sent to you. Daily Fantasy Tax Reporting.

If you receive your winnings through PayPal the reporting form may be a 1099-K. Just because a taxpayer doesnt receive a tax form it does not make the winnings. Please advise as to where I input this other income that is not considered gambling however it was gambling winnings.

Fantasy sports winnings of at least 600 are reported to the IRS. How do I opt in to electronic-only delivery of tax forms 1099 W-2G from DraftKings. If you qualify to receive tax forms from DraftKings IRS Forms 1099W-2G you can access the information directly from the Document Center.

If you qualify to receive tax forms from DraftKings IRS Forms 1099W-2G you can access the information directly from the Document Center. For Oregon activity please contact the DraftKings Customer Support team as the information in this article may not apply to you. Key tax dates for DraftKings - 2021 Where can I find my DraftKings tax forms documents 1099 W-2G.

If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. If you receive your winnings through PayPal the reporting form may be. Does DraftKings issue 1099s.

You can expect to receive your tax forms no later than February 28. DraftKings has requested and received an extension of time from the IRS to mail its 1099-MISC recipient copies. If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC.

The IRS limits your net loss to 3000. If you receive your winnings through PayPal the reporting form may be a 1099-K. If your account has crossed the 600 net profit threshold for 2015 you should receive a 1099-MISC forms in the mail in the next 2-4 weeks.

Sweepstakes winners get 1099 forms. Why am I being asked to fill out an IRS Form W-9 for DraftKings. Fan Duel sent me mine via e-mail about a week ago.

The only place I see where a 1099-MISC is applicable is Small Business Self employed which is not what my DRAFTKINGS form is from. DraftKings seems to think that since they have the option to file for an extension they should do that most years because they cant do things in a timely fashion. How do I update personal information on my tax forms 1099-Misc W-2G for DraftKings.

A majority of companies issue tax forms by January 31st every year as required by law. Your maximum net capital loss in any tax year is 3000. If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC.

We will withhold federal income tax from the winnings if the winnings minus the wager exceed 5000 and the winnings are at least 300 times the wager. The first thing to realize is that any winnings are taxable and bettors should include it on a tax return. Fanduel sent me a tax form just the other day dont use draftkings so im not sure how they go about it.

Draftkings Sportsbook Nj Promo Code For 1 050 Bonus Offer

Draftkings Tax Form 1099 Where To Find It How To Fill

Draftkings Tax Form 1099 Where To Find It How To Fill

Draftkings And Golden Nugget Merger Imminent Online Casino Plans

Draftkings Sportsbook Promo Code Apr 22 1 000 Free Bet

Draftkings Sportsbook Ohio The Best Sports Betting App Coming Soon

Draftkings Ny Mobile Sportsbook App Promo Review Launch Details

How To Make A Draftkings Deposit Guide Banking Options

Draftkings Sportsbook Review 20 Up To 1000 Deposit Bonus

Draftkings Colorado Promo Code 1 050 Sportsbook Bonus

Draftkings Tom Brady Team Up For Nft Marketplace On Draftkings App Sportico Com

Draftkings Pennsylvania Sportsbook 1 Mobile Pa App 1 050 In Bonuses

Draftkings Sportsbook 200 Free Bets For Nfl Nba And College Football This Week

Draftkings Florida Is Draftkings Legal In Florida April Update

Draftkings Raises A Stink About Massachusetts Online Gaming Proposal Boston Business Journal

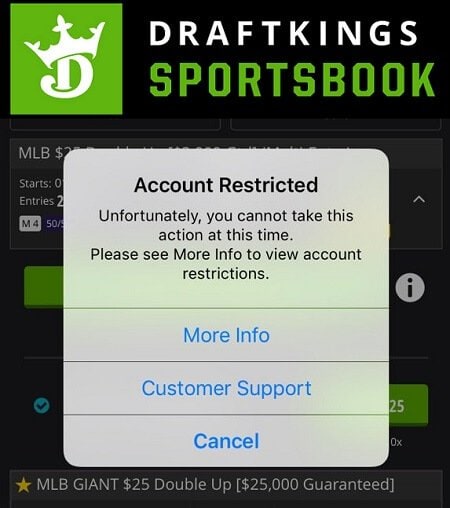

Restore Restricted Or Locked Draftkings Sportsbook Account

Play Draftkings Or Fanduel The Irs Wants To Know About Your Winnings Nasdaq